Петр Щедровицкий

Innovation production

conveyor.

Who is responsible

for innovation production?

Kovalevich D., Shchedrovitskiy P. Innovation production conveyor. Who is responsible for innovation production? // Attila Szigeti : Startup Studio Playbook. 2016. С. 53-92.

1. Introduction

The second half of the 20th century, the agenda of various economic entities, from national governments to transnational companies, was focused on the sources and principles of innovation processes. Indeed, who can and should be responsible for producing innovations?

What are the parties and position holders to undertake industrial implementation of technology innovations and, as a result, to increase labour productivity and economic efficiency? And, finally, the responsibility for the employee incomes and their family living standards?

The discussion on these issues breaks out regularly — every time a new generation of technologies replaces the previous one. Such periods are now used to be called and described in terms of industrial revolutions. Without any doubt, in our life, we are lucky to face the next round of sharp disputes on innovation.

According to many experts, this is not by accident, since the new industrial revolution, regardless of its sequential number assigned, is already knocking on the door

However, this is not a theoretical conversation at all. The polemic on the innovation producer as a subject is primarily going on between those who have already answered this question themselves. It can be said in some way that this is not even a discussion, but rather a mutual efforts to inform those who have decided on their bets along with the agreements and game rules required to be established in this area.

This article is striving to describe how modern technology entrepreneurs respond to this question, while creating a new profession of the venture builder or, in other words, turning technology entrepreneurship into a serial activity that is a conveyor for the innovation production.

As the conveyor is not created in an empty space, the innovation process quality will largely be determined by the actions of other professional as well as social and cultural positions. Let’s try to figure out who the entrepreneur sees when looking around, and who he has to build an effective interaction with.

2. 500 years of partnership

The history does not know a more important partner for a technology entrepreneur than an engineering inventor.

It is safe to consider that since the insightful way of thinking, generally developed by the 15th century, crystallized in engineering, economic development has been determined by the technological labour differentiation.

Adam Smith showed this process effects by the example of the operational specialization in a workshop producing ordinary pins (Inquiry into the Nature and Causes of the Wealth of Nations, 1776). The labour productivity in the course of transition from the handcraft labour, characterized by the whole pin to be made by one artisan from start to finish, to the technology processing, when the work on creating a pin was divided into 18 operations each assigned to a separate person, increased 200–250 times.

It is the increase in the labour differentiation intensity that was proposed by Smith to be considered as the only source of wealth.

His idea seemed too revolutionary to his contemporaries and even later thinkers. However, today we understand he was right: the role of natural resources and their circulation in the world’s economy has long been incomparably insignificant in contrast to the engineering inventions contribution. Over five hundred years, the partnership between the inventor and the entrepreneur has generated at least three major types of professional engineering: engineering, design, and, after all, applied scientific research.

Engineering as a type of occupation and profession, previously available only to individual geniuses, became a mass field of activity.

Inventors became owners of their intellectual product: the first legal guarantees for intellectual property protection appeared in the end of the 16th century, and the famous Statute on Monopolies, which registered the 14-year term of patent rights and restricted the king’s right to establish monopoly activities, was adopted in England in 1623.

The current invention, as it exists in Europe, appears to be highly specialized professional activity involving applied technology researchers, engineering solutions developers, industrial technologists and system engineers to participate in various functions, producing various types of invention knowledge.

The conveyor for inventions is assembled, components are delivered on time, the individual section performance is synchronized, followed by the output that is a serial product developing its quality standards.

Alongside with the labour differentiation in the field of inventions, the economic role of technology entrepreneurs was also increasing, compared to the contribution of those who made money on the redistribution of resources by virtue of wars, trade, management, etc. For technology entrepreneurs, the flow of engineering innovations became a source for business and profit, as it generated a field of opportunities that entrepreneurs learnt to use in order to create previously nonexistent activities.

This idea was maximized by Joseph Schumpeter (Theory of Economic Development, 1912). According to him, an entrepreneur is exclusively a technology entrepreneur, the only one who produces innovations. He breaks down old market structures replacing them with the new ones, performing so-called creative destruction. In fact, Schumpeter not only introduced entrepreneurship as a leading position in the economic development process, but also put an equal sign between the innovation and the product of entrepreneurial activity, thus justifying engineering and entrepreneurial partnership from theoretical point.

3. Catch up and surpass

A different view of the driving forces and internal structure of economic development will be found if we focus on the position of the so-called national state.

Since the zero industrial revolution was conducted by technology entrepreneurs and engineers in the late 16th century and the United Provinces (present-day Holland and Flanders) became the world’s economic center for more than a hundred years, dozens of countries have set themselves the tasks of catching-up industrialization many times.

On the one hand, any catch-up industrialization has an apparent advantage — the advantage of underdevelopment. It is always easier to copy someone’s already developed technological achievements than to create them over again.

The discussion of the whole variety of catching-up industrialization institutional matrices is beyond our subject matter. At the same time, it can be argued that as the gap in industrial development between the leaders and the applicants increased, the national state and its administration tried to play more and more significant role in compensating for backwardness.

Such projects were developed in different countries at different times: in France in the 18th century, in the USA, Germany, Japan, Argentina and Russia in the 19th century and in the USSR, Mexico and China in the 20th century.

On the one hand, most of the catching-up industrialization projects relied on the strong engineering schools development, and on the other hand, on the professional development of the state apparatus itself, aiming at replacing the technology entrepreneur functions with the good state machinery organization. On the other hand, institutional mechanisms establishment question arouse each time, regarding their intention to compensate and overcompensate for the unreadiness of the legal institutions and social professional organizations of the specific society for the industrial revolution.

The efficiency of such projects is still an issue of concern for representatives of various social sciences, i.e. historians, sociologists, political analysts as well as for the field of practical politics. It is important for us to emphasize that regardless of such substitution results in specific countries and historical circumstances, these processes always had one common consequence — they significantly, and sometimes irrevocably distorted the economic fundamental structure — first of all, the prices of those resources that were required for the business project implementation. Caused by this, the entrepreneurship was deprived of the right to establish exchange values of the manufactured product, hence the part of the property rights, thus, entrepreneurs were forced out to the regions less influenced by the state apparatus.

Even in countries that did not come up with a question of superiority of the entrepreneurial innovation production method over the state at all, since it was obvious to representatives of the national elite, entrepreneurs were forced to form institutions that restrict the rights and possible influence of the state structures and officials. A striking example is the Bank of Amsterdam (1609) which was the first central bank institution in the history to regulate the exchange rate in accordance with the balance of business supply and demand, and the city authorities were forbidden to get loans there. Or later, it was Unity Creates Strength Trust (1774), a Dutch investment trust, created to diversify the national risks of entrepreneurs by investing in other jurisdiction.

Today, the work of state apparatuses in many countries, where the natural private business activity remains lower than in the leading countries in terms of the technological race, is intensified by further technology packages changing, which outlined its main features at the turn of the 21th century.

As in previous historical periods, this work is not limited to creating institutions that stimulate and support innovation, which means creating technology entrepreneurship and the inventor-entrepreneur interrelation, but is directly aimed at compensating for its functions.

4. 20th century innovation officer

The exposition will be incomplete if we forget to introduce another figure into the space of entrepreneurial orientation, that is the organizer (or management specialist). Despite the fact that this is the youngest position among those mentioned above, as it is only a little more than a hundred years old, it is one of the most popular professions today. Notably, professional management owes the inventor-entrepreneur partnership its appearance and rapid growth in the 20th century.

To clarify this point, let’s now think back to the last decades of the 19th — the early 20th century.

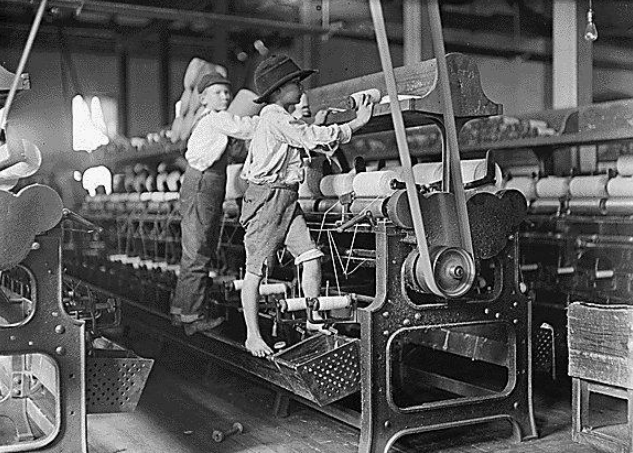

Smells of oil and gasoline were in the air, reflecting the second industrial revolution growing in intensity, meanwhile the phenomena of the previous revolution were around represented by the English manufactories of the late 18th century, playing the key role in the industrial process organization but tragically not ready to accept a new package of technologies.

In terms of contrast, this picture is comparable to what a modern neuroengineer sees during his visit to the Zlatoust steelworks.

Contemporary management appeared as a result of the efforts to increase labour productivity in the factory (and to bring this point of the first industrial revolution in line with the tasks of economic globalization at a new stage).

Frederick Taylor, a mechanical engineer by training and chief engineer of several American industrial enterprises, noticed a gap between the possibility for the multiple increase in production efficiency and the operational decisions made by the managing owners, so that he brought the organizational development experience from the field of invention and engineering to the management sphere. His scientific principles of labour organization imply a direct transfer of the differentiation and specialization method regarding variable engineering knowledge to the sphere of administration, organization and management. Taylor disintegrated the knowledge necessary to manage a technologically complexified production into eight different types of management activities, placing them literally on different floors of organizational and managerial activity.

Following Taylor, engineer Henry Gantt, his student and fellow, along with Karol Adametsky and Walter Polyakov, created the first professional management tools which were the base maps for manufacture planning, now known to a first-year management student as Gantt Diagrams.

Among the pioneers of the new era, those who managed to use the work results of Taylor and his followers to the full extent, was Henry Ford, who built the first technology transnational corporation from scratch. This is not surprising, after all, Taylor’s practical work was opposed vigorously by labour unions, capital investors and many engineers at that time, since it was focused primarily on restoring the lost functions of technology entrepreneurship in old companies. Describing the purpose of his diagrams, Gantt characterized them as requirements for the manufacturing entrepreneurial system to function and develop (Organizing for Work, 1919).

Trying to professionalize a part of the entrepreneurial work in order to increase factory productivity, Taylor set up an opportunity for a new industrial process organizational structure to emerge.

It is exactly the pair of the transnational corporation (TNC) and the hired management that held the position of the main producer of innovations for most of the 20th century.

A significant part of innovations covered the sphere of so-called organizational innovations, i.e. methods and ways of operating activities seen as complicated ones concerning that time. At the same time, traditional engineers were moving to corporate R&D centers in large numbers, reasonably counting on the large companies stability and their management competence.

The share of technological outsourcing, which reached almost 100% at the end of the 19th century (and at the end of the first industrial revolution almost all invention was carried outside the companies and factories — in private laboratories and universities), was reduced to a barely noticeable 3% in corporations of the 1960s, so only those studies which results were not industrially-oriented remained outside the transnational corporations.

It is not surprising that as far as the second industrial revolution technologies and industries, such as the production of cars, fertilizers, fossil fuel, antibiotics and other large-tonnage products exhausted their potential for efficiency upgrading, the number of inventive organizations independent of transnational corporations, began to grow again, thus, the share of technological outsourcing was 25% in the late 1990s, and it will inevitably increase further.

5. Costly affair

Every product used at the beginning of the 21st century, comprises 50—80% of direct and indirect management costs.

At the same time, the price of management itself began to grow rapidly. Trying to understand and catch the idea of new technology trends, managers of large corporations began to invest in additional training, in even more specialized management, and, finally, directly in increasing their personnel quantity, significantly increasing the average costs for this. It’s been long time since inflation, mainly formed as a result of labour costs increase, couldn’t keep pace with the growth of managers’ incomes.

Every product used at the beginning of the 21st century, comprises 50—80% of direct and indirect management costs. If it is hard to be felt in terms of household items, then visit the manufacturing workshop of any vertically integrated company and ask about the amount of overhead costs — if it is honestly said, you will hear a figure from 200 to 800%.

At the same time, the influence of this professional group on the labour productivity and the technology development is dramatically decreasing. The material technologies potential that formed the basis of the second industrial revolution is exhausted to the same extent as the life of intellectual, knowledge, technologies that performed well in the previous stage of development.

Resulted from the collaboration of engineers and entrepreneurs to increase labour productivity, the management has become one of the key factors of its decline a hundred years later, leaving the part of functions within the implementation of the given entrepreneurial projects.

However, the social role of managers should not be underestimated, it is unlikely for anyone else in the field of innovation to have more restraining influence on the pace of technological development today.

Thus, in the field of innovation, in addition to the technology entrepreneur, we now see the following. Firstly, a group of inventors who divided labour among themselves, therefore staying extra-productive, who, due to their work results low appliance, try to deal with some of the entrepreneurial tasks themselves, which, of course, turns out to be failing. Secondly, the government officials who sincerely believe that they took into account the mistakes of their predecessors and came up with such new tools that they would definitely succeed in riding the technology development this time. Thirdly, a trade union of super-trained managers who are confident in the stable future of large corporations, whose number of specializations exceeds the number of seats in a medium-sized football stadium.

The declared navigation method defining the development process parties and providing an understanding of their goals, is required by the entrepreneur only to proceed to the business projects development and implementation, given the distinguished position characteristics.

So, how do technology entrepreneurs act today, in a situation of a new industrial revolution emerging?

6. Skills vs serial production

Over the past 25 years, a previously non-existent phenomenon, that is the serial technology entrepreneurship, is possible to be met in regions with a high density of inventive activity.

This new type of entrepreneurship still does not have a common name, being called innovation networks, entrepreneurial partnerships, startup studios or startup production factories. But they all have one thing in common: new technology businesses have become their mass-produced outputs. They are imagined, developed, produced and sold on the series basis.

In Cambridge, England, an entrepreneurial partnership, with Herman Hauser as one of the leaders, develops a dozen new companies per year, while the entire hundred-thousandth University campus creates more than hundred startups for the same period. In Leuven, Belgium, the R&D center established forty years ago as the center for technology transfer and currently appearing to be independent of the university, creates a dozen and a half startups per year, while the entire Leuven cluster (also with a population of one hundred thousand people) develops 40–50 of them. For several successive years, the Russian public-private network of startup factories, or nanotechnology centers, produces 200 companies annually.

These are no longer accidental outbreaks, but a new type of escalating venturebuilding business. It should not be confused with venture capital funds functioning exclusively to invest capital raised from various sources in startups not created by their own.

Serial technology business building is an intervention into the entrepreneurship inner sanctum, a stake on transformation of an indescribable and inexpressible art of a few business geniuses, as it was previously perceived so, into a new profession. In the sense if its logic, this attempt is similar to the one started 120 years ago and implemented in creating the profession of organizer, i.e. manager. Even 300 years earlier, engineering work was successfully standardized and became widespread.

Simultaneously along with the production of technology startups as the key product, venture builders develop basic principles and norms of business activity itself, which, when formulated and described, become suitable for distribution.

As far as specific goals, tools, basic operations and products of serial entrepreneurship are announced, along with the disintegration of previously indivisible entrepreneurial knowledge, an increasing number of people are getting access to business. Those become involved in the startup building who previously could not compare themselves to legendary business persons of the past or Elons Musks of the present.

7. Time value

How is it now possible that the company, not the products it develops and produces, but the newly-built company itself became an independent large-scale object for sale?

The invention availability, whatever it is — a new technical concept, a complex engineering device or a manufacturing technology, still does not clarify what kind of business it is possible to create on its basis. We know dozens of unique engineering solutions that have never been applied in the economy. Moreover, we also know thousands of inventions that have failed to become a framework for building sustainable businesses.

Already mentioned above, J.Schumpeter considered innovation to be not the invention itself, but the implemented way of using it withing the system of technological labour differentiation. After all, it is never known in advance what exactly from a technologically realistic menu of inventions will be economically reasonable. This is the process that entrepreneurs are responsible for, implementing their business experiments, excluding countless options and projects from consideration.

They invest the only irreplaceable factor in creating a new activity — their time. The first entrepreneur to achieve results becomes some kind of a monopolist.

Not by virtue of driving competitors out of the markets, but because he is the first to enter the new system of labour differentiation, or rather, because he creates it. The position of all the other innovation race participants is catching up with him. In this situation, in order to regain their leadership, they can and often do make the most important decision to save time by buying the thing created by the first entrepreneur.

Samsung, which placed its stake on leadership in smartphones based on flexible screens, purchases startups developing the necessary technology packages batchwise.

Siemens operated in a similar manner, acquiring the LMS Belgian startup, which created the world’s best for that time technology for 3D simulation and modeling of complex mechatronic systems to be applied in aviation, engine building and other fields, for several hundred million euros. The examples can be continued endlessly.

In the framework of technological platforms changeover and new stages of technology revolution being launched, the time that inevitably needs to be spent on selecting an invention and its inserting into industrial circulation, becomes a determinant of the new companies value and a driver for growing businesses.

To say for sure, it is the time spent on the business experimentation, encased in the form of a new company, that appears to be the product that the entrepreneur sells. And the buyer is the one for whom, due to the increased speed of technological changes and the economic futility of trying to do everything on his own, time has become more valuable than money.

8. The era of affiliation

The product offered by venture builders to managers of large and medium-sized companies in order to integrate it into the emerging industries of the new industrial revolution, is the saved time.

In order to have a startup applied, those of them whose companies were created on the basis of an old technology platform and the model of highly integrated corporations, have to pass an extremely painful stage of their vertical structures unpacking first of all. If they don’t go through it, they risk losing their investment. The tightly-built organizational machines of these companies are able to grind the cores of new businesses with passion that is worth being applied the other way.

In the practice of serial entrepreneurs of the last decade, there are many cases when a startup was decided to be sold for a lower price, but only provided that the buyer-company was ready to accept it without destroying. In order to distinguish them from the classic transnational corporations of the 20th century, the companies of this kind, that are up to act so smart, with their age unlikely to exceed 25–30 years, are often called third-generation corporations. Let’s take the ASML company as an example, that is the global leader in the production of lithographic machines. Apart from a distributed network of thousands of suppliers producing 95% of all the components it needs, it also created consortia of R&D partners, hence keeping only the most complex technical processes for itself. Over the past ten years, the technology outsourcing of the world’s first lithographic company has reached 50% of the total amount of invention required for this technology development.

Today, ASML takes another step breaking traditional management patterns, it forms alliances with serial technology entrepreneurs, in fact setting them a technical task to create new types of business required for its future development. In the new industrial revolution, deep mutual business affiliation is turning from a tricky technique into a key characteristic of entrepreneurship.

9. Open opportunities

In the context of excess inventions, how does an entrepreneur find his way and identify technologies applicable to become a new generation business?

The ASML case is an example of a new, but already advanced industry — nanoelectronics. More frequently, a modern technology entrepreneur has to deal with the creation of not yet developed systems of labour differentiation, that do not imply major players or established value chains. So, how does a serial entrepreneur know what to do in this situation? How does he get oriented in excess inventions produced by engineers, and identify technologies to be used as a base for a new generation business?

Answering these questions, we imagine a bazaar-like market, where, wandering between the shopping rows, the entrepreneur makes decisions guided by his willpower, thus instinctively choosing promising developments. It is possible to meet such a way of the entrepreneur’s working even today, but it is so much different from the serial venture builder’s reality as the Ford’s conveyor from boutique car repair shops of the late 19th century. Over the past decades, the inventor-entrepreneur partnership has made a giant step towards the technologization of the entrepreneurial opportunities production.

Any individual invention, regardless of its tactical and technical specifications, acquires its value only by virtue of its possible participation in a long technological chain

In order to be successful, individual technology focal points of a serial venture builder require, firstly, the mutual alignment of the particular technology parameters with neighboring chain sections and, secondly, the economic efficiency of the entire system of technological labour differentiation still being created.

It is pointless to invest in creating a technology of super-productive equipment for weaving composites, if, on the one hand, it cannot be provided with a sufficient amount of necessary material, and on the other — a sufficient scale of its product consumption. In fact, when an industry has not been formed yet, the serial entrepreneur has to invest his time and resources simultaneously along the entire future value chain, or at least on the basis of integral estimates of its structure and development rate. In the course of evolving labour system, his current priorities for action depend on which new activities fell behind other activities showing more intensive growth. His space for operating is a kind of interactive map that shows the maturity of specific future value chain elements, including the so-called final consumption.

The screens located in the situation room of the venture builder, display actions carried out by all those who work together with him to create a new industry, these include engineers’ plans and programs, technology companies’ investment and, of course, the actions of other entrepreneurs. Only with this regularly updated knowledge at his disposal, the serial entrepreneur is capable of making decisions on business priorities at any specific point of time.

New forms of engineer-entrepreneur partnerships serve as a kind of headquarters for such builders of technology companies. In 2014, the Solliance center, the world’s largest alliance engaged in the sphere of building-integrated photovoltaics (BIPV), was opened in the high-tech campus of the University of Eindhoven. The efforts to work in this direction were put together by the four major European technology centers (IMEC, ECN, TNO and Julich), the group of leading engineering universities (Eindhoven, Delft, Leuven and Hasselt), several dozen companies that develop and manufacture complex equipment and materials (VDL, DSM, Roth & Rau, etc) and technology companies planning to use these technologies in their further development (ThyssenKrupp, the German metallurgy giant, is among them). Not only was the entire future industrial-scale technology production chain assembled on one site, but, most importantly, those players who claimed to occupy various business positions in the future system of labour differentiation became partners to each other.

The site organized in this way became a demo structure of future industries including, for example, the industry of new building materials with integrated solar films to use for roofs, windows and facades. This allowed venture builders, including the Russian ones, to become the Solliance system partners. The technology and position map of this collective technology producer provides a possibility to see, as on a screen, how the density of efforts has been already distributed to create a new industry and, most importantly, what places are not occupied. The task of such an alliance is not only to develop a package of technologies, but also to share operational knowledge within a multi-professional community, i.e. awareness of opportunities available for a limited time due to the actions of many players. This knowledge plays the role of a chance for the serial entrepreneur, as he builds the future businesses architecture on its basis.

10. Available technologies

So, the technology entrepreneur has set goals — he knows exactly what businesses it makes sense to build now and how much time he has for implementation. Feasibility of these tasks is caused by the entrepreneur’s access to the technologies necessary for creating a business.

As for our country, it is probably due to the long period of closed economy and the almost complete absence of third-generation companies, that a number of steady myths have appeared concerning the access to technologies. The two most considerable of them, that don’t endure over time, are about the world’s best engineering inventions to be inapproachable, and the advanced technologies to be extremely expensive.

As mentioned above, the periods of changing technology platforms are characterized by non-captive (independent of large corporations) engineering centers and various types of their consortia to play a key role in creating new technologies. The economic stability and modern R&D independence is impossible without such models of cooperation with entrepreneurs, which would allow engineers to make the maximum of their inventions conveyed into industrial circulation. This is achieved, on the one hand, by involving a wide range of entrepreneurs and companies in setting tasks for their projects, and on the other hand, by dividing their expenditures, causing technologies to become affordable.

Here are some examples. Scientists of the Israeli Weizmann institute of science conduct applied research, some of which is patented. It is an independent business council that decides which results to patent (the institute does not conduct contract work with any corporation in the world). Licenses to use patents are given free of charge, on the terms of future royalty. And this is despite the fact that, on average, the time from the scientific results publication to the appearance of goods on the shelves covers a period of 15–20 years.

By this scheme, access to cutting-edge research is provided to any technology entrepreneur who knows exactly how he is going to use the patent.

Industrial technologists of IMEC, the world’s largest independent R&D center in the field of microelectronics and its ways of application, collect so-called affiliation programs. Each program focuses on creating a package of technologies for one of the emerging industries, from large-scale flexible electronics to mass integrated sensors. Several dozen companies, sharing the expenses, can simultaneously join the program as industrial partners.

For example, given that the annual IMEC work value in terms of a particular line of business is 5 million euros, with 10 partners involved in the program, then each of them pays 500 thousand a year, thus receiving non-exclusive rights for all intellectual property produced under this program. At the onset of a new industry, non-exclusive rights are enough for an entrepreneur to conduct his business experiments.

At the same time, this model significantly increases the level of business expertise of the developed industrial technologies, dramatically reducing the number of engineering errors and thereby reducing the development time. In this context, the common term “open innovation” means nothing more than mass access of entrepreneurs with any amount of capital to the best global technologies that are created in a shorter time than in traditional intra-corporate models.

11. Total outsourcing

Being aware of what to do and where to get the necessary technology, the serial technology entrepreneur starts building a specific business within limited time.

What can help him to do this faster than other entrepreneurs or large technology corporations?

The crucial operational principle of venture building is to focus the efforts of the startup’s engineering team only on the future business technological core by distributing all the other tasks outside with no exceptions. The term “outsour cing” is used here to talk not so much about the functions ensuring a company’s creation — legal, financial, accounting, reporting, and others. First of all, it is the case of transferring most of technological processes outside the startup — from industrial design and prototyping to the components development and full-scale production.

As a particular consequence of this model, the typical startup budget structure provides the share of personnel costs at the level that may not exceed 20–30%. Frequently, this contradicts the standards used by most Russian and foreign state development institutions to provide financial support for innovation.

The team’s focus on one key business staging point leads to a dramatic acceleration of engineering work. If calculate the hours each of us spends on secondary tasks every day, experience shows this time to account for 50—70% of the working day. In addition to reducing direct time losses, maximum concentration allows to involve the mileage length factor that is the amount of accumulated knowledge and skills.

According to research, success in any engineering profession directly depends on how long a person does not interrupt his or her work in a particular field.

Any person consistently absorbed in certain activity for more than 10,000 hours (seven years of focused continuous work) automatically gets into the top thirty experts on this issue in the world. Continuous intensive work for more than 20,000 hours opens to the engineer doors to take one of the leading positions.

It is possible for the venture builder to quickly distribute all tasks that are not related to the startup basic operations, provided that he has access to the relevant startup’s technological profile.

They actually play the role of infrastructure in reference to the process of the startup building. From the point of operating, important things include not only the physical proximity of the infrastructure that is ready to provide technological services, but also their operational business model. Therefore, the basis of any modern cluster that meets the requirements of serial entrepreneurship is open contract technology services and production facilities.

As for this business model, service technology companies do not have their own product, the stake is made on increasing the speed and reducing the cost of engineering and manufacturing processes, and, finally, prices for their services are set in a flexible way, depending on the complexity of the tasks. Such infrastructure businesses have become possible to be build within the sphere of mechanical processing due to the combination of the most advanced automatically programmed tools and additive technologies; in industrial biotechnology, the role of infrastructure is played by genomic sequencing and genetic engineering.

12. Hard and soft infrastructures of the serial entrepreneurship

Today, such functions of each company as personnel management, supposed to be strictly internal, are also switching to the open service model.

Engineer leasing is one of the world’s fastest growing infrastructure business sectors. Since a startup requires at least half of the engineering qualifications to be engaged for a limited time from several months to several years, anyway, it is more profitable for the venture builder to lease the necessary specialist to carry out a specific task. The engineer also benefits from this type of cooperation with the entrepreneur. He gets an opportunity to take part in various field-oriented projects within the framework of his basic specialization, without any doubt, making his knowledge more profound.

Against the background of this process, last year’s decision of the Russian lawmakers to ban personnel leasing looks surprising — the desire to “whitewash” the market for baby-sitting and other types of self-employment deprives Russian venture builders of the opportunities offered by the main global trend in personnel management technologies.

Finally, different types of technologies need not only different equipment and different engineers, but also different types of premises and different engineering infrastructure. Over the past ten years, a series of brilliant technologically specialized development companies has grown in the world. Their staff, along with architects and designers, includes experts from the relevant industries (biotechnology, microelectronics, etc.), who know exactly what their type of technological process needs, how professional equipment develops and what its development requires in terms of premises.

Today, such developers not only fulfill tasks of large customers (corporations, R&D centers and universities) at high quality standards, but also independently invest in the creation of specialized infrastructure in specific locations — for groups of technology startups that have not been created by entrepreneurs yet. Decisions on investments with such a level of risk that goes far beyond the parameters that are usually acceptable for the development business, are made by these companies only in collaboration with venture builders. It is the latter that, due to the serial nature of their activities, can provide realistic guarantees of filling and cost-effective use of new, strictly specialized premises.

Most of the service businesses of this kind require significant capital, thus, it is extremely difficult to concentrate the infrastructure for several new technology packages at one specific point. Roughly speaking, today the cost of an “infrastructure package” in any development area of the new industrial revolution is as follows: a single cluster can afford to deliver only one complete package. For venture builders, their activity geography is defined by the local ecosystem specialization: it makes sense to create flexible electronics startups in European Eindhoven and Cambridge or Russian Troitsk, and, for example, Leuven, Berlin and Novosibirsk are best suited for the field of regenerative medicine.

The principles described above, allow serial entrepreneurs to treat their work like any other production process: the faster and cheaper the company is produced, the greater amount of possible profit the entrepreneur will get when selling it. The total labour differentiation mechanism allows regulating the cost and, to the necessary extent, influence the speed of the pipeline for creating technology startups.

13. The genius of William Jevons

Discussion on innovations does not know more popular figures as investors, business angels and venture funds.

Their money is called the capital, and even the blood of projects, both startups and development institutes try to get them on their executive boards. Conditions for capital raising is a key innovative strategy point for any modern region or state.

The reason is clear: it is the investor who is trusted with the last word when deciding whether the idea is worthy of accepting capital.

This responsibility sharing model assumes that the investor is able to use his experience to distinguish really deserving offers from impracticable projects. He is also responsible for evaluating the project team, business model, market potential, etc. In fact, he is delegated the lion’s share of entrepreneurial work. Finally, saving the drowning (those who invests money) is to be done by their own (by investors).

Under the pressure, traditional investors hire a workforce of business analysts and investment experts with MBA diplomas. They, in turn, overwhelm startup builders with document templates required to be filled in, hire consultants specializing in specific markets or technologies, prepare multi-page business plans and submit them for approval by the boards of their investment or venture funds.

Experts and supervisors often ask the question: is such performance of 3% per year worth the costs for management that constitute up to 20% of the total fund capital over the seven-year period of its existence? The investor can only respond with one thing — successful sales of invested companies and the amount of profit at the moment of the fund closing.

The questions that the venture builder has to answer while making both his own and attracted investments in the companies he creates, are different. Isn’t it absurdly to make a strong-willed bid at the starting point of creating a new business and to determine all the key technological forks? Especially that, their overcoming in a situation of changing technological platforms and candidate solutions redundancy, constitutes the essence of his, venture builder, work.

Why spend time preparing volumes of calculations and diagrams, if real knowledge about the economic indicators of a particular engineering solution and the scale of consumption, that has not been formed yet, can only be provided in the process of building a business?

Finally, how should venture investment be arranged so that its principles allow regulating the pace and amplitude of the invested capital up to the procedure of startup freezing-unfreezing, depending on the actual construction speed in terms of a particular company?

Serial entrepreneurs themselves are sometimes called investors (of seeding or early stages), but this designation does not reflect the nature of the process. William Jevons, a brilliant English economist and philosopher of the 19th century, made the more close approach to the core of the subject. He introduced the term “uninvestment” in relation to business investments, which can be interpreted as disinvestment.

According to Jevons, the entrepreneur does not invest but actually implements an opposite process, turning the initial stock of capital goods at his disposal (including finances) into a working enterprise.

With initial capital stock decreasing at each subsequent moment, the key question is: will the entrepreneur have time to build a functioning company, that is, a company independently reproducing the required operational and development resources, within the limited time for which he has sufficient resources. It is the time limit for uninvestment that the entrepreneur deals with.

This idea of entrepreneurial work, coupled with the seriality of the process, allows venture builders to radically restructure previously established investment practices. Most often, serial entrepreneurs try to separate large investments in material infrastructure (equipment and specialized premises) from investments in intellectual property packages and investments in product startups. This separation allows them, on the one hand, to break the direct dependence of the capital investments success on the specific startup success, and on the other hand, to increase the efficiency of using capital-intensive equipment due to its selection, which makes it possible to use it simultaneously in several businesses created by the entrepreneur.

Thus, the venture builder separates investment objects that have different time lengths of the possible functioning from each other, multiplying the efficiency of financial and other types of capital.

For the portfolio investor, this approach to investing is fundamentally impossible. Even if he invests in several companies at once, according to the logic of financial risk diversification, they should be unrelated to each other.

He always invests in an individual entrepreneur, who, in turn, builds only one business.

Thus, the entrepreneur’s failure to meet the time limit for uninvestment means writing off the resources spent, at the best case, with compensation to the investor for a small part of them due to the sale of the project material traces on the secondary market. There are many examples of such situations. Caused by this, today, in relation to serial entrepreneurs, traditional investors mostly act as some buyers of the companies they produce along with large corporations.

Investing not in individual companies, but in the business of serial startup creation, although rare, is already found in the global investment landscape.

There is no doubt that in the foreseeable future we will see the formation of the institution of specialized investors who bring capital to venture building companies.

14. Entrepreneurship becoming mass produced

The most frequent question that successful entrepreneurs ask serial venture builders: “How can you create dozens of startups at the same time, each of them requiring from 5 to 8 years to be spent on?»

“Do you really understand each of the technologies and areas of activity so deeply to create competitive products?” they add.

“Impossible,” they conclude with a silent statement.

This typical conversation brings us back to the key idea of this article, which is its main thread – to the thesis about economic development to be achieved by immersing into the technological labour differentiation. Intuitively, it is understandable and accepted by most observers who are attentive to economic reality. However, as soon as we transfer this same principle from the sphere of material production to the sphere of intellectual processes – to the production of knowledge, intuition fails.

At the beginning of the article, we mentioned the work done by the founders of modern management, Frederick Taylor and Henry Gantt, dividing the previously one whole activity of the factory’s manager into 8 separate specialized management positions. This work later made it possible to create enormously more complex management systems — transnational corporations. Until the moment of a radical increase in the depth of division of intellectual managerial labour, this could not be implemented, or even predicted. And of course, it would not be possible to increase the management systems efficiency by such a level, which allowed the economy of the 20th century to develop at a previously unimaginable pace.

We are confident that the same destiny of specialization and technologization will affect entrepreneurship in the 21st century, at least its content, which allows creating new technology businesses technologically and serially, i.e. in a steady and repeatable manner along with an increasing quality level. We can see examples of such work in different regions of the world. We can highlight the already established norms of venture building, some of them being already described in this article.

There is no doubt that serial entrepreneurship designates a new economic development style, by analogy to the main invention of the last century, it can be called a conveyor for the innovation production. Any new activity takes several decades to develop, so it will take no less time for serial technology entrepreneurship to become a mass activity being accessible to many millions of people in the world by virtue of labour differentiation and specialization.

Let’s just try to be a little more attentive to events already occurring, though barely noticeable, around us, maybe this will allow us to see something different than the ordinary landscape outside the window.